How PSD2 & Strong Customer Authentication affect your payment success rates

In this article, we’ll investigate the effect that PSD2, and mainly SCA, has had on the payment success rates in the European Union.

The authentication landscape post-3DS2 implementation

Ravelin, a company specializing in advanced fraud detection and prevention, launched an investigation into how the authentication landscape has evolved after the shift from 3DS1 to 3DS2.

Interestingly, out of the transactions that are processed through 3DS2, only 82% complete the authentication successfully. While this seems like a great percentage, if you flip it around and say close to one in five card transactions fail authentication, it sounds a lot worse.

When asked about their views on 3DS and conversions, 69% of ecommerce professionals said that they are concerned or very concerned about the effect of 3DS, showing that there’s still a lot of unrest in the market.

Here at MultiSafepay, we’ve seen developments that back up these results. Across different markets, the overall conversion rate has increased after 3DS2, but even with this improved authentication flow there are still too many transactions that fail at the authentication stage.

What happens when a customer needs to authenticate?

If a customer is guided into a non-frictionless authentication flow, they have to prove that they are who they are by providing a biometric verification. While this authentication has been changed to be more customer-friendly, it's still one of the main points of friction in the payment process.

Ideally, you want your customers to make use of a frictionless 3DS authentication or, if possible, a SCA exemption (such as Transaction Risk Analysis), as these greatly increase the chance of your payment success rate due to there being no action needed from the consumer (and no chance of a failed authentication).

Payment success rates across European markets

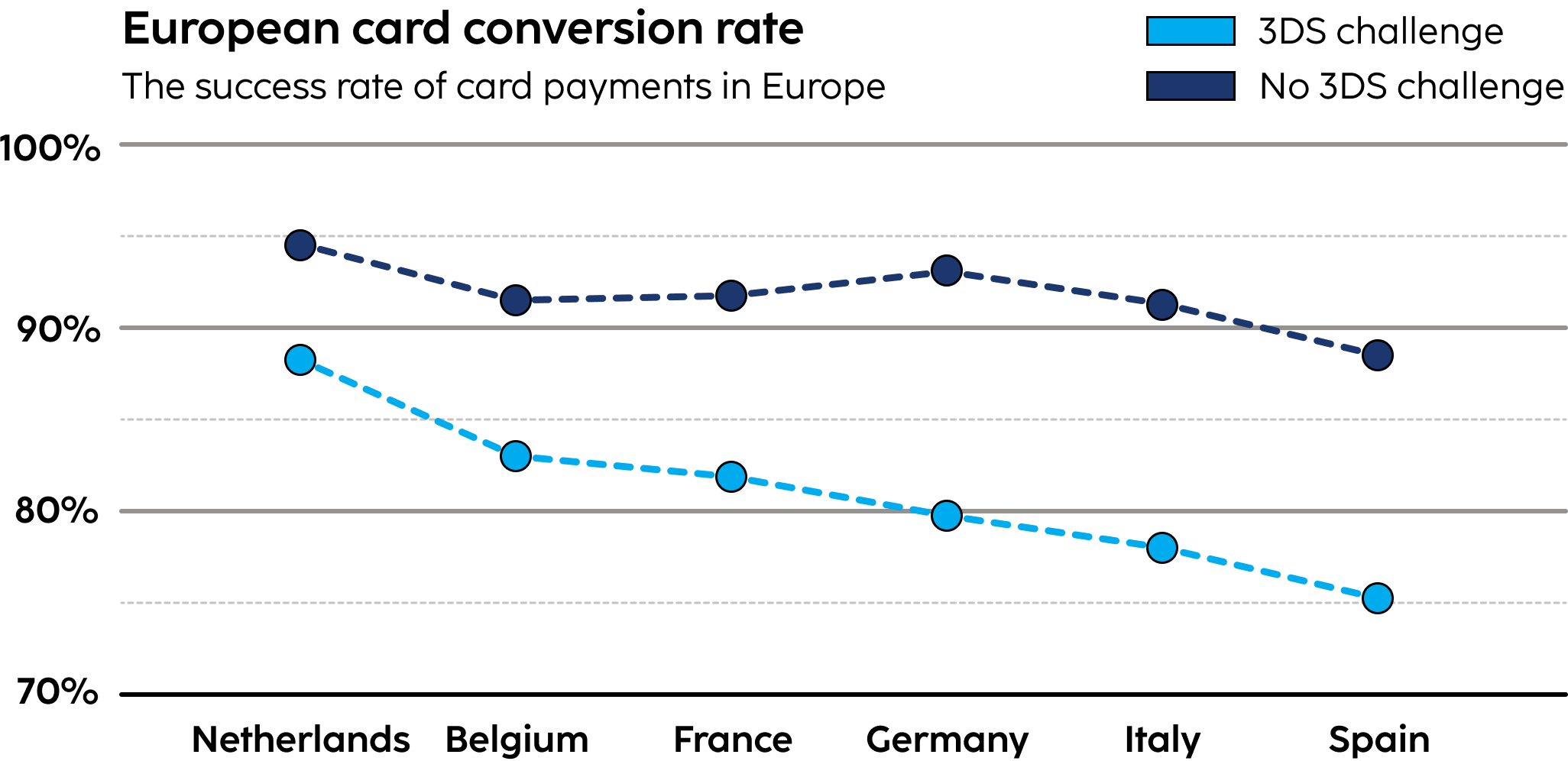

Across European markets the average conversion rate for a 3DS authenticated transaction lies around the aforementioned 82% mark, but there are significant differences per market. In some markets the conversion rates for a 3DS challenge lie as low as 75%, while more authentication-friendly markets operate close to 90% success rate for a 3DS authentication.

In the added graph, the conversion rate of card transactions is shown per market, for both the 3DS authentication payment flow and a flow without authentication.

As the statistics show, every market shows a drastic increase in conversion when a transaction is not prompted to authenticate.

The smallest difference being around 7% for the Netherlands, while Southern European markets such as Italy and Spain boast differences around 13%.

Working with an acquirer, such as MultiSafepay, will allow you to take advantage of these significant differences. By analyzing your traffic together, we'll identify the best way to improve your credit card conversion rate. Whether through the SCA exemptions above, or alternative checkout optimizations, we have various methods of improving your payment operations. If your business processes many credit card transactions, increasing your acceptance rate by even 5% can mean a drastic increase in turnover. With MultiSafepay's extensive risk and fraud analysis tools, you can aim to do just that and more.

Sentinel – Your ticket to a higher card conversion rate

To simplify the SCA authentication process, we've got just the thing. Our solution allows you to use our extensive risk engine to make use of SCA exemptions where possible.

“By using Sentinel, we increased our card conversion rate by almost 20% in the same month – a dramatic difference, especially in a market like our where credit cards are so popular.”

LaCuraDellAuto.it

If you're looking to do the same, you can download our whitepaper for more information on our solution. If you've already made up your mind, reach out to our ecommerce experts or your account manager to discuss the options for your business.