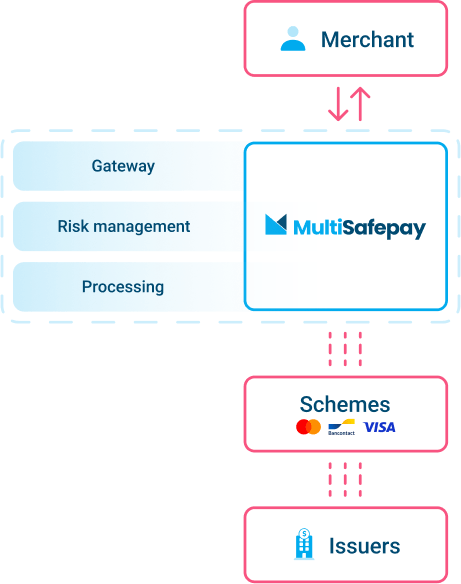

Less third parties - more control

A fully licensed acquirer and processor has more influence over the payment flow. From the moment of payment to the reconciliation in your books, you want as much control as possible. We have a direct connection to the major schemes, allowing us to process transactions completely within our own network – without unnecessary third parties.

What does this mean for you?

More control

To create the best payment network there’s two essential steps to get right.

It all starts with your own infrastructure and network. Making sure you’re building something robust and reliable, with plenty of backup solutions.

Once you’ve established a setup that works, remove unnecessary third parties - which is what we did.

We now operate solely within our own infrastructure, which has proven itself, time after time, to be the best network on the market.

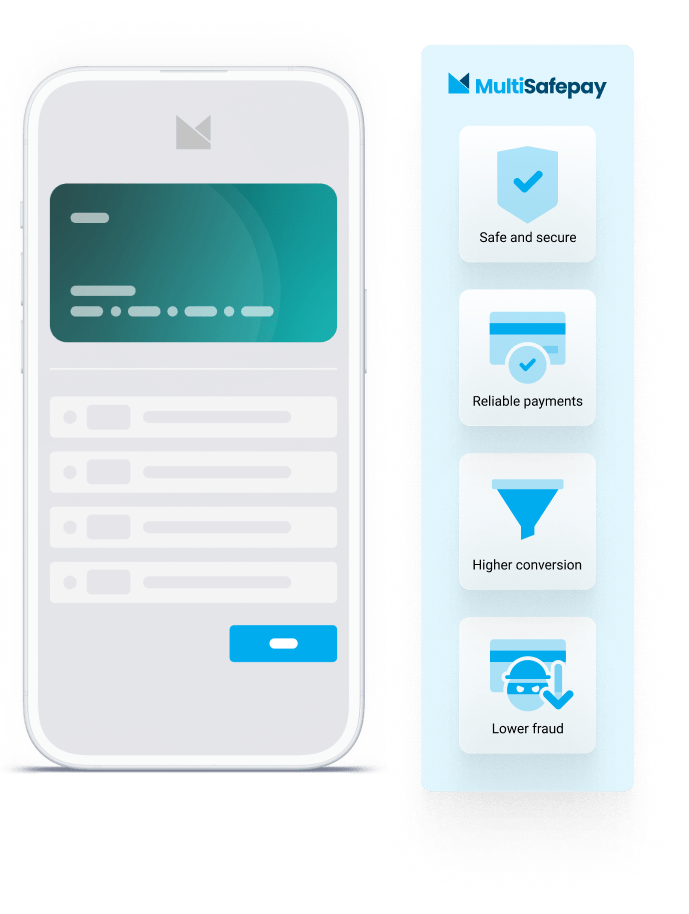

More successful payments

The increased influence an acquirer and processor has really comes to fruition in the conversion.

By finely tuning and tweaking the overall authentication and authorization process, transactions through our acquiring platform just perform better.

We’ve helped some of our merchants increase their conversion by drastic rates, going up to 20% improvements.

More accurate fraud engine

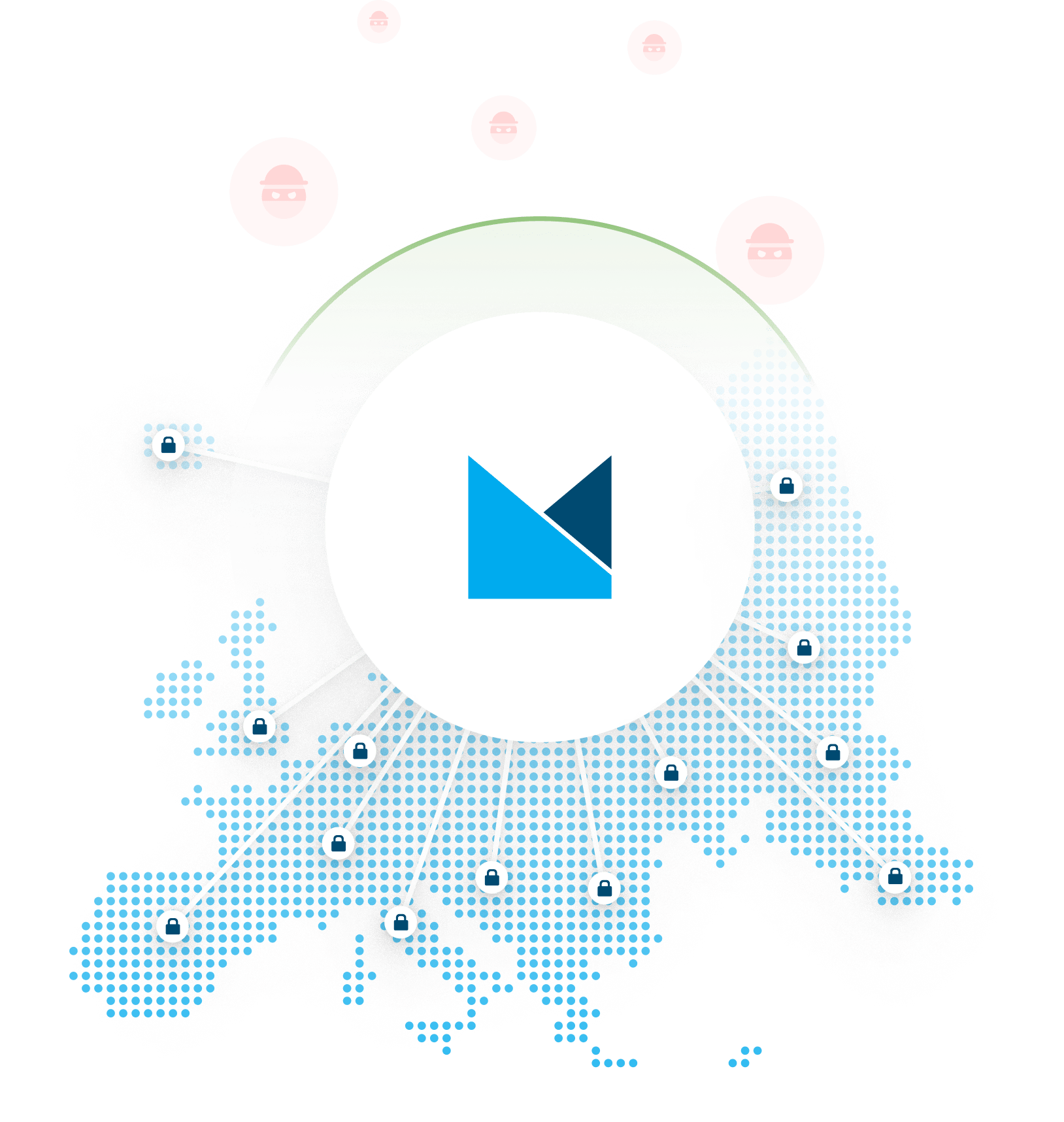

As a long-time payment processor, we’ve built up a reputation as one of the safest, lowest-fraud processors on the market.

By using machine-learning to carefully analyze the transactions that run over our platform, we’ve built up a solid model that carefully weighs the risk between revenue and safety.

The result is one of the safest, highest converting payment platforms.

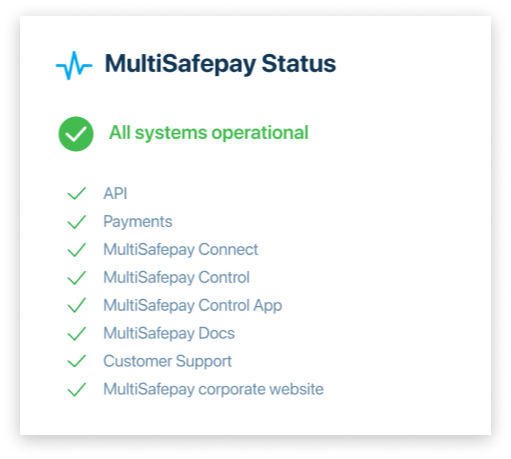

Network uptime

More uptime = more revenue

You can take the best measures against outages, but there’s always a chance you have a disruption - that's just the nature of ecommerce.

But what can't happen is the inability to react. We built our infrastructure so that we’re in complete control. In the case of an outage, we’re able to switch between our multiple Dutch data centers

If there’s an outage we can fix from our side - rest easy knowing you’ll be back up in no-time.

Our track record speaks for itself.

Revenue optimalization

Getting more out of your existing business

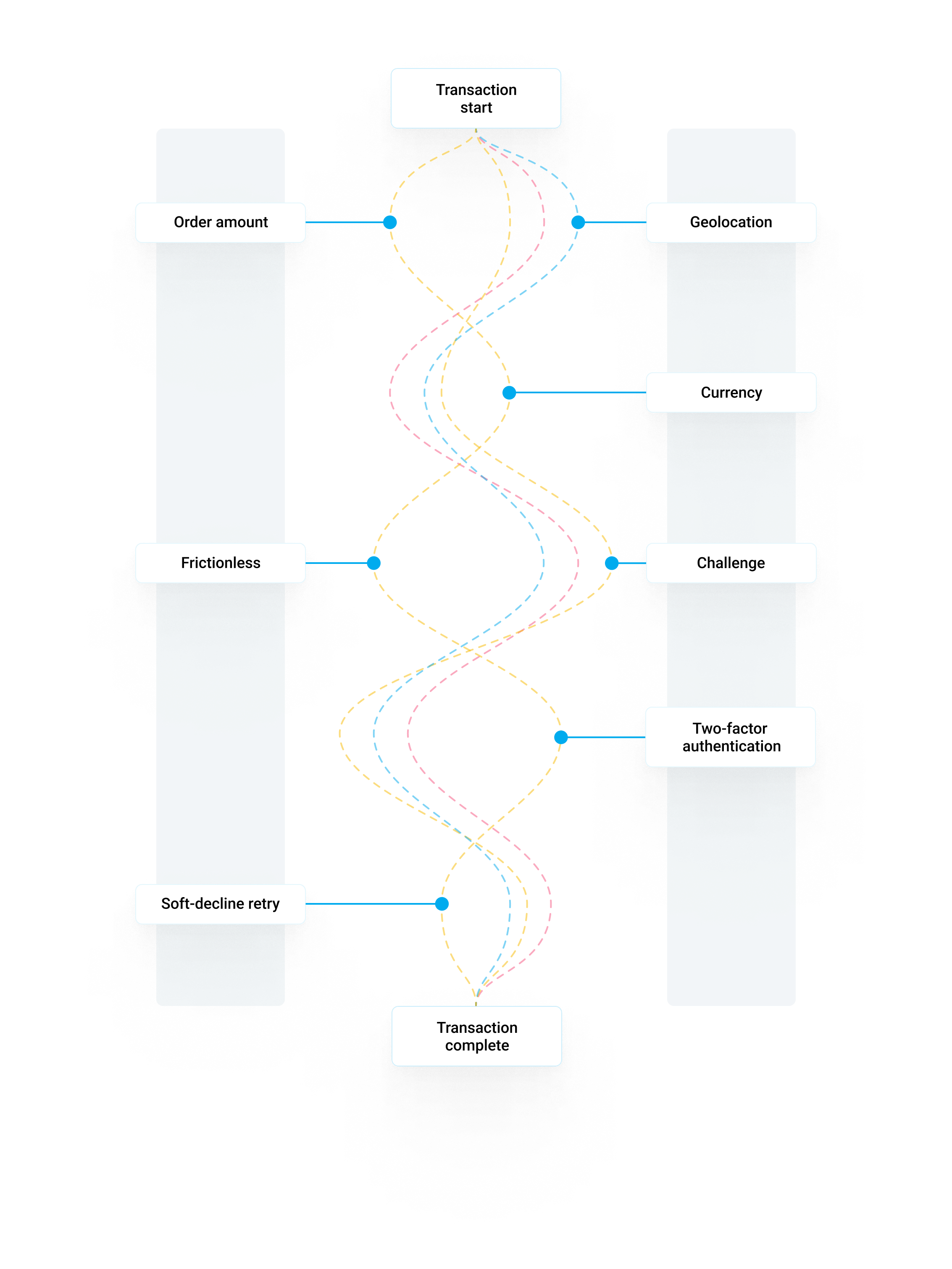

Making the most of your existing payment traffic is a complicated process. The end-to-end payment flow is influenced by many different factors, and the communication between an acquirer such as MultiSafepay and the card issuer is one of the key influencers in this process.

Our dedicated acquiring team is consistently looking at ways to improve our authentication rates across the board, giving our merchants access to new ways of getting more out of their business.

Acceptance & authorization rate

Processing through an acquirer can lead to sharper fees when it comes to payments. But instead of focusing on the cost per payment, the focus should be on the checkout. If you’re paying a cent more or less per transaction, it might sound substantial with the right volume, but the real difference comes in the acceptance rate.

If you use a payment provider that successfully processes payments at a higher percentage, the cost-saving effect of a fee that might be a cent less is quickly wiped out by the sheer amount of transactions that would be declined under the less efficient party.

While we focus on providing the best fees possible (which due to our acquirer status can be among the best on the market), we understand that pushing our acceptance rate to the max is the best way of making our merchants more money - so that’s what we do.

Revenue protection

Years of knowledge at your disposal

Utilizing a risk strategy that walks the line between risk and revenue is essential in maximizing your revenue.

Our platform has a built in fraud detection layer that’s constantly looking to push the boundaries of what’s possible. By taking data points across all of Europe into account, our model is perfectly engineered to process your payments in the safest way possible.

Established fraud level

Our fraud level is at the lowest in the PSP segment, which is apparent in our ability to perform risk assessments at the transaction level, and process them under a TRA exemption up to € 500 - which only the best performing fraud engines are allowed to do.

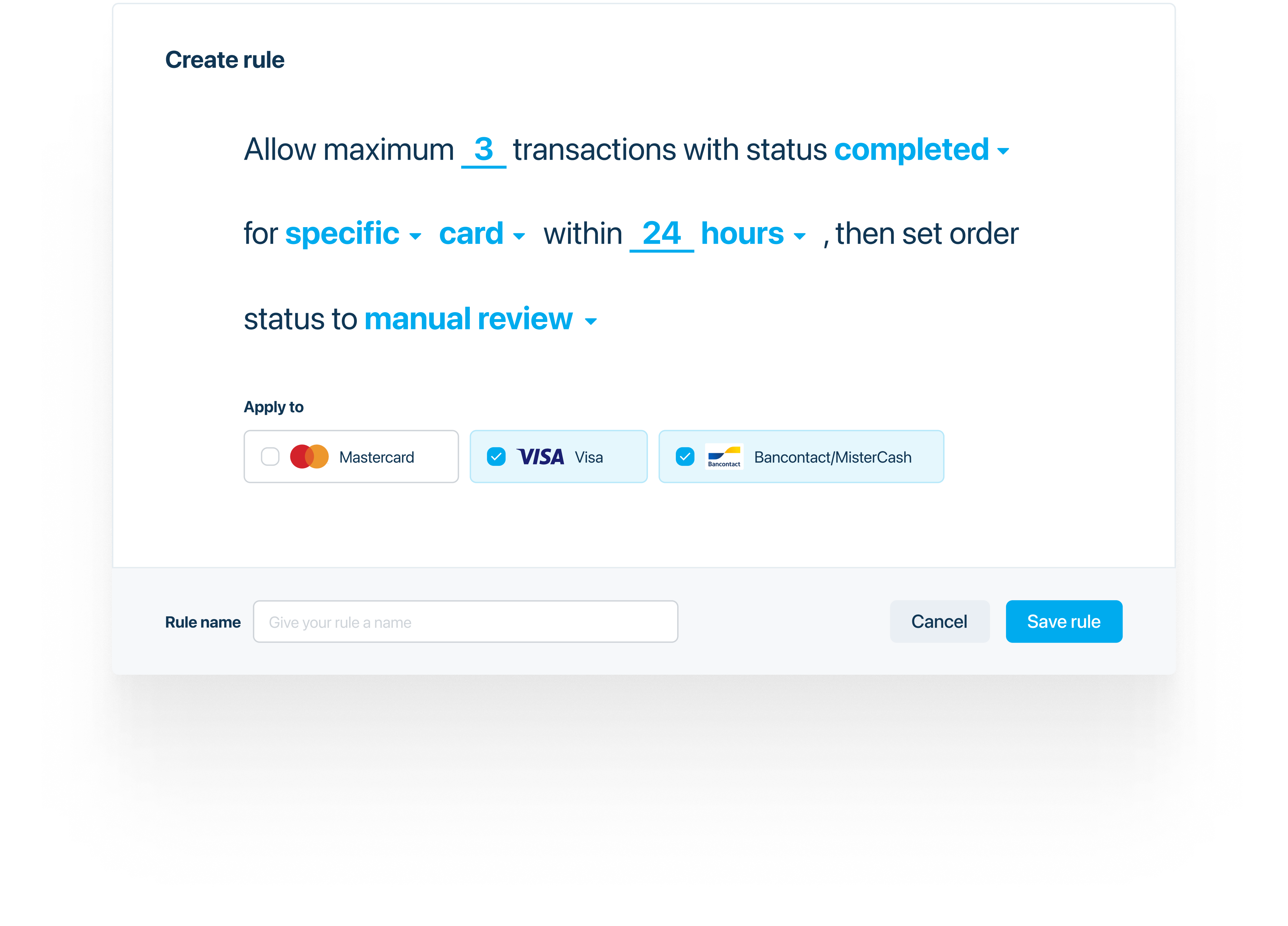

Want to be in the driver’s seat completely?

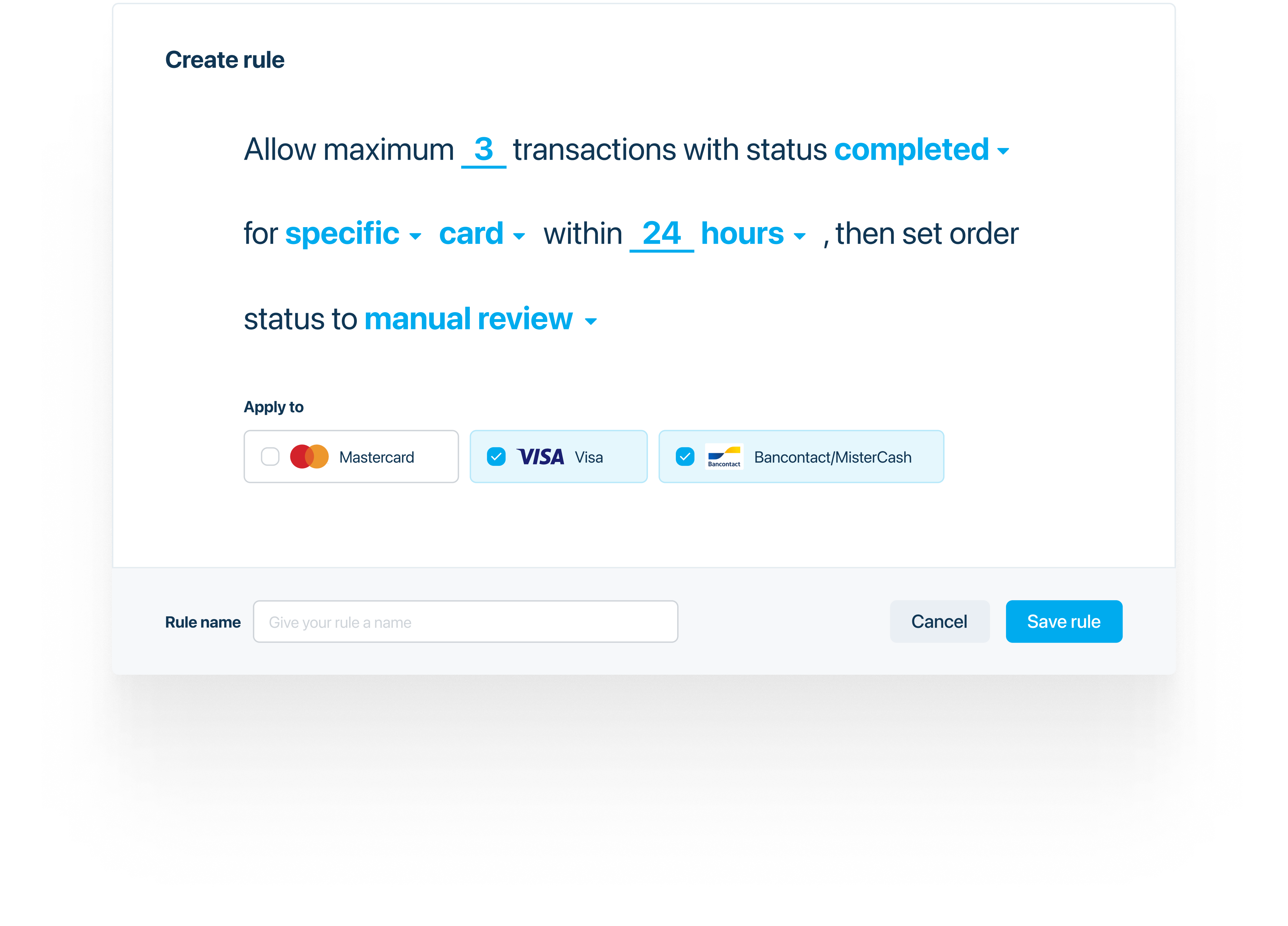

While our engine functions perfectly on its own, there are options for companies and teams with the capacity to take it a step further. If your company has the desire to gain even more control over your payment infrastructure, Sentinel might be just the thing.

Through Sentinel your fraud and risk teams will be able to white and/or blacklist customers, but also adjust 3DS rules and exemptions.

Thinking of upgrading your payment infrastructure?

If you’re not processing with us yet; let us help you.

Let’s run some of your payment traffic through us and we’re sure your card conversion rates will be higher.

Up for the challenge?