Get ready for Black Friday

Tips and tricks to get your business up to speed for Black Friday.

5 stages in which you can optimize your payment journey:

The customer journey in your webshop is one of the most important elements of success. Identifying what’s needed to increase your chance of success at each stage will drastically increase the turnover in your webshop. Our various solutions are perfectly suited to help you hone in what your (potential) customer needs.

Discover what solutions we offer to help you convince your webshop visitor to shop with you.

Stage 1

Safety first: Secure your business

It’s all about the fundamentals

On a day such as Black Friday, you don’t want to deal with disruptions or fraud. As an acquirer and processor, we understand security is at the top of the priority list, and to help you, we’ve compiled a list with the key points for you to enjoy a safe and successful Black Friday.

Learn everything you need to know about a safe online shopping environment in the article below:

Relevant reads:

How to lock down your webshop on Black Friday

2 minutes read

Stage 2

The right checkout for the right customer

OK - you did it. The customer chose your webshop.

Now how do you keep them coming back?

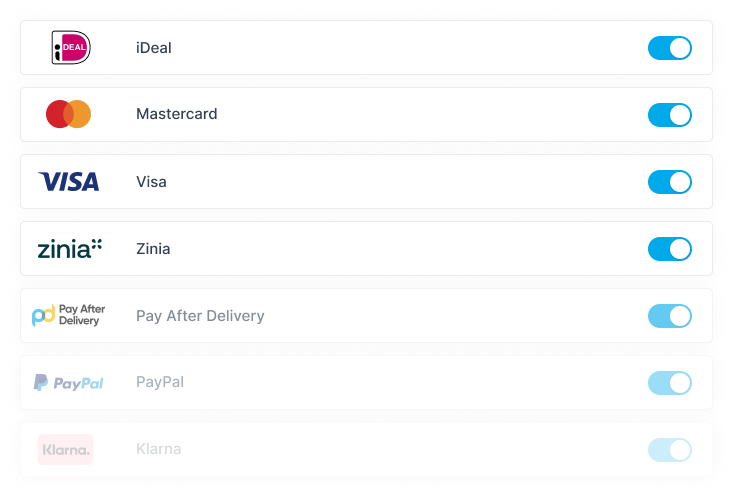

Offering the right payment experience is crucial - checkout conversion. Making sure your checkout matches your products, your customers needs, and your market are at the top of your list.

Your payment mix needs to match all these variables.

With the latest payment trends in mind, we have an up-and-coming payment method that’s looking to grow into a major player in the BNPL payment industry:

Zinia by Openbank & Santander.

This BNPL focuses on next-day payouts, and creating a consumer and merchant friendly collection flow.

Check out the article below to learn all the benefits it has to offer.

Everything on Zinia:

Openbank & Santander present: Zinia

3 minutes read

Stage 3

No more confused customers

No more wasted time

Unfortunately, not everyone keeps their order - so how do you minimize the effect of customer questions about refunds and payments on your business?

One of the leading causes of customers reaching out to customer service is questions about payments, so how do you minimize this?

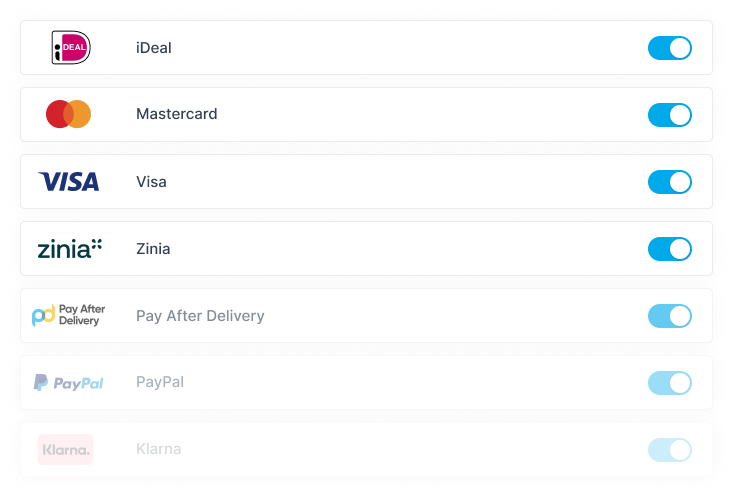

Our merchant, The Little Green Bag, suffered from exactly this issue. The majority of their customer service requests were about refunds that customers couldn’t locate in their banking environment. Leading to their customer service spending (or wasting) valuable time on these simple requests.

Luckily, our Virtual IBAN is just the thing.

“After implementing virtual IBAN, we noticed our related customer questions drop from about 60 a month to 0”

Charissa Jokhoe,

Customer Operations Manager @ The Little Green Bag

By changing the name that shows up in the customer’s bank environment, payment-related customer requests can be a thing of the past.

Learn more about VIBAN:

VIBAN - Say goodbye to customer confusion

3 minutes read

Stage 4

Make transaction #2 even better than transaction #1

The payment went well, the customer is happy. Everything went according to plan. Now what can we do to make the next visit even more accommodating?

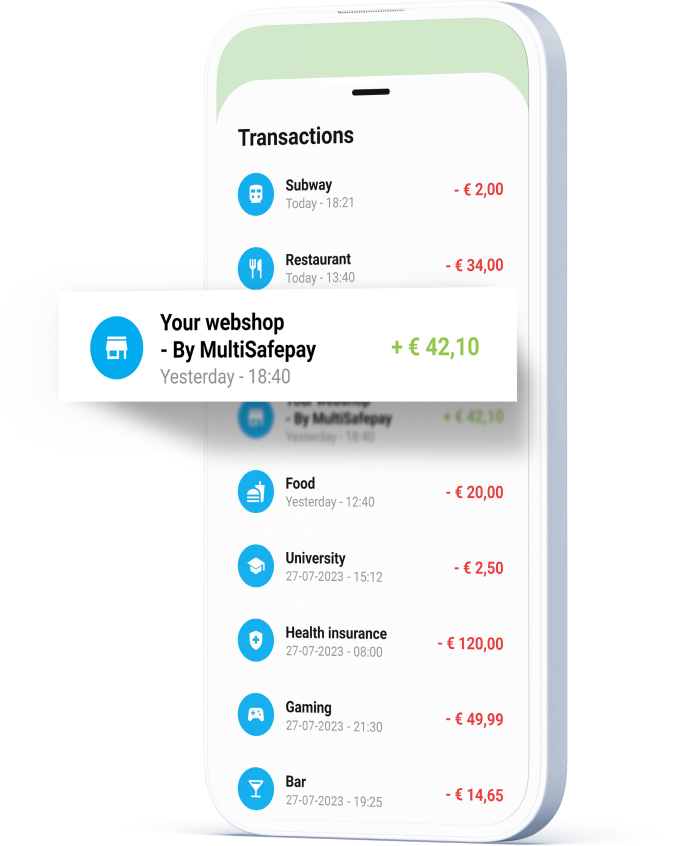

One of the best ways of creating great experiences for returning customers lies in the technology called tokenization.

You’ll probably recognize it from its use in many of the popular digital wallets, which safely stores sensitive payment data, only for users to activate this with only one-click.

Through MultiSafepay, you can also activate tokenization. Safely store cards on-file, creating a token that can be used without additional authentications or verifications.

Tokenization in a nutshell:

Payments explained: Recurring payments

2 minutes read

Stage 5

Bringing it all together

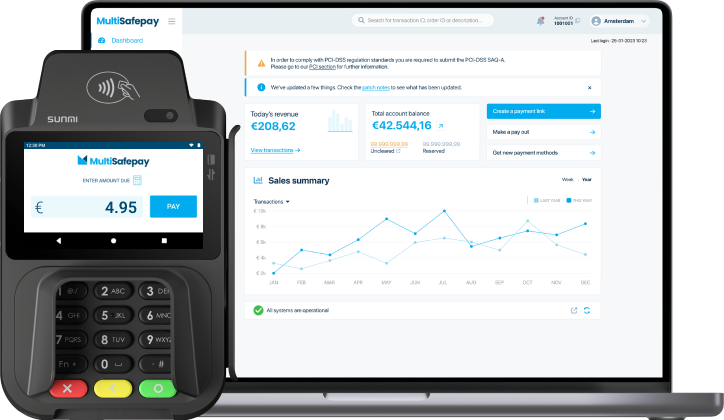

The final, ultimate step: omnichannel

If your business has an online and physical store, the key that’ll unlock many different benefits is linking both these domains together.

Through the MultiSafepay omnichannel setup, you can streamline and improve the customer experience, and many of your key business operations, significantly

Relevant omnichannel reads:

Omnichannel payment reconciliation

3 minutes read

What is omnichannel

2 minutes read

Omnichannel advantages with MultiSafepay

Manage and view all your data in one place

By bringing together your online and in-person data streams, you can create better customer profiles, leading to more accurate and successful marketing campaigns.

Access next-gen SmartPOS payment terminals

The MultiSafepay payment terminals are equipped with the latest Android software, allowing you to run advanced apps and software to manage your business.

Automate your reconciliation & accounting

Running all your data through one stream enables you to create one automated reconciliation flow. No more manual reconciliation or tedious work managing two different data streams.

Ready to make this a Black Friday to remember?

Our ecommerce experts will gladly help you activate any of the payment solutions mentioned above.