What challenges and opportunities do platforms face in the current market

Platforms as a business model: advantages and drawbacks

The success of platforms is undeniable. It is an innovative business model with multiple advantages and opportunities for growth.

But what benefits do platforms have over other business models?

- Digital platforms can reach a global audience easily, connecting businesses and consumers in different markets without a physical presence in the country. The reason why is that the platforms don’t offer their own products.

- The ability to personalize the user experience is excellent. They handle many insights that help them understand businesses' and end consumers' preferences and needs, so they can offer better recommendations or incorporate more personalized products and services.

- Platforms are highly scalable businesses, as their repetitive model is easily replicable in any market and with minimal investment when compared with other types of business. That's why platforms can obtain significant development and benefits even sooner.

However, platforms also present significant challenges:

- In such a competitive world, accelerating and simplifying internal platform procedures is so needed. The large amount of documentation they must collect to register an affiliate (KYC), for example, often slows down the entire onboarding process, which is a major handicap.

- Platforms also must deal with many regulations that change depending on the country they operate in. In Europe, we have the PSD2 regulation for electronic payment security, which they must strictly comply with to avoid heavy fines.

- Platforms handle a large volume of transactions and data, so optimizing their processes to have absolute control over all information is one of their main challenges, as reconciliation errors can bring extra costs, and not having the right insights can affect their conversion ensuring that data is correct.

Five processes to optimize your platform operations

As you surely know, the conversion rate is one of the main factors to consider when it comes to business, as it directly affects your profitability.

A good conversion means more revenue, better visibility, and a good ROI, which attracts more online stores as affiliates. However, if your conversion rate is low, you're missing out on opportunities to expand your business.

Due to the complexity of the platform business model, establishing the appropriate channels to achieve better conversion rates can be challenging.

Platforms are complex businesses with particular needs, so speeding up and simplifying internal processes to offer your clients frictionless management and a better user experience that increases their average ticket becomes a leading necessity to remain competitive.

Let's talk about five key processes you can optimize on your platform to simplify the most important processes and thus help you improve your conversion and revenue.

#1 Accelerate your onboarding process (KYC)

One major point platforms face is the onboarding process and the mandatory KYC verification (Know Your Customer), subject to PSD2 regulations, as by law, platforms must verify their customers' identity and all personal and fiscal information for greater security.

This process is often long and complicated, especially for businesses that handle large volumes. Mainly, the customers don’t upload the right documents in time, but sometimes the onboarding process isn’t clear.

So, collecting all the necessary information (ID, fiscal data, etc.) is difficult, consuming a lot of time and resources.

At this point, your payment provider must offer you the necessary tools to streamline KYC verification through automation, thus simplifying the whole onboarding procedure and associated costs.

Can you imagine verifying 20 customers one by one?

A personalized onboarding link for each customer's needs significantly speeds up the process. Forms can be adapted, and documentation reduced to suit the type of business that you affiliate with your platform.

You can reduce friction, improve the user experience, and therefore help you improve your benefits.

#2: Ensure PSD2 compliance

When processing payments, security is always a crucial topic. The real challenge for a platform is maintaining the balance between security and ease of use.

MultiSafepay, as payment ecosystem experts, emphasizes the importance of working with a payment provider with international licenses to comply with PSD2 regulations. This is a way to ensure that all the required security measures are implemented to protect against fraud in all your operations.

On the other hand, double authentication is also an essential requirement. This additional authentication process (SCA), which takes place once the customer has entered their payment details, adds an extra layer of security to prevent fraudulent activity.

At MultiSafepay, we take security very seriously. For this reason, we have international licenses that allow us to operate in compliance with PSD2 regulations. This allows us to provide 100% secure payment procedures to platforms, enabling you to work with total confidence while avoiding potential fines for non-compliance with regulations.

Offering secure end-to-end payments on your platform generates trust for your customers and end-users, resulting in increased confidence in your platform as a "safe place" to carry out the different transactions.

The more security, the more trust, the better your results will be.

#3: Use a single control panel for all your operations

Managing all your operations from a single control panel is one of the most effective ways to optimize your business processes.

With a single dashboard, processing diverse types of transactions from your platform, such as refunds, sending payment links, or rewording multi-divided or recurring payments, can help you avoid processing errors that ultimately translate into extra costs.

In addition, with a single control panel, you can have a better command of all the information, obtaining better insights and an overview of all your affiliates.

Thus, you have a better foundation for optimizing decision-making, such as changing the selling price or having greater control over the payment flow.

At MultiSafepay, you can trigger payments through the API, work with different currencies without switching accounts and customize the billing process depending on the customer.

We highlight from our experience that centralizing all your operations in a single control panel significantly improves the efficiency and productivity of your platform, saving time and resources needed for administration. This allows you to focus more on your business and its development possibilities.

#4 Connect your business units with automated reconciliation

When managing large volumes of transactions, the procedure of efficiently tracking your revenue is complicated, especially when dealing with complex transactions such as installment payments, partial refunds, and charges.

In these cases, automated reconciliation is the perfect solution that allows platforms to automatically reconcile their financial and accounting records, helping you ensure your reports' accuracy and manage all your financial transactions quickly and concisely.

At MultiSafepay, with our automatic reconciliation API endpoint, you can simplify all your accounting processes, easily managing complex financial operations such as bank and credit card account reconciliation, among other procedures, making your reconciliation a simple and scalable approach, regardless of the volume of business.

The scalability of your accounting process is more important than it may seem in the first place.

As we mentioned earlier, one of the platforms' strengths is their repeatable model when expanding the business, so your reconciliation must also be scalable to acquire a sustainable growth.

Additionally, automated reconciliation saves time spent on spreadsheets and other manual processes. It brings more efficient platform management, reducing management time and extra costs due to errors that can come with manual reconciliation.

#5 Monetize your platform for a better result

In addition to the revenue generated through your software (SAAS) or sales of POS systems, mastering the art of effectively monetizing your platform is vital to ensure its long-term profitability.

But what type of monetization is the most suitable?

The answer depends on the type of platform you are managing. For example, a single-line business model differs from a marketplace. So, let's see the differences:

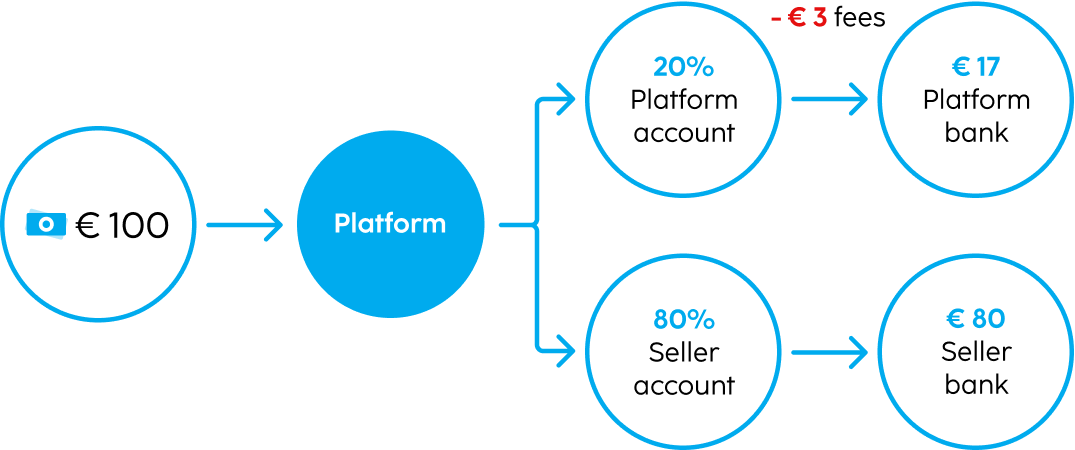

Split payment: This monetization model involves splitting the payment in real-time. The process is simple. In dealings with 2 associated accounts (affiliate and platform), the division of the sale occurs automatically when the transaction is completed.

Furthermore, you can add the splits you want if they have the same criteria. In this model, deductions can be made through a percentage of the total sale or with a fixed amount, regardless of the transaction amount.

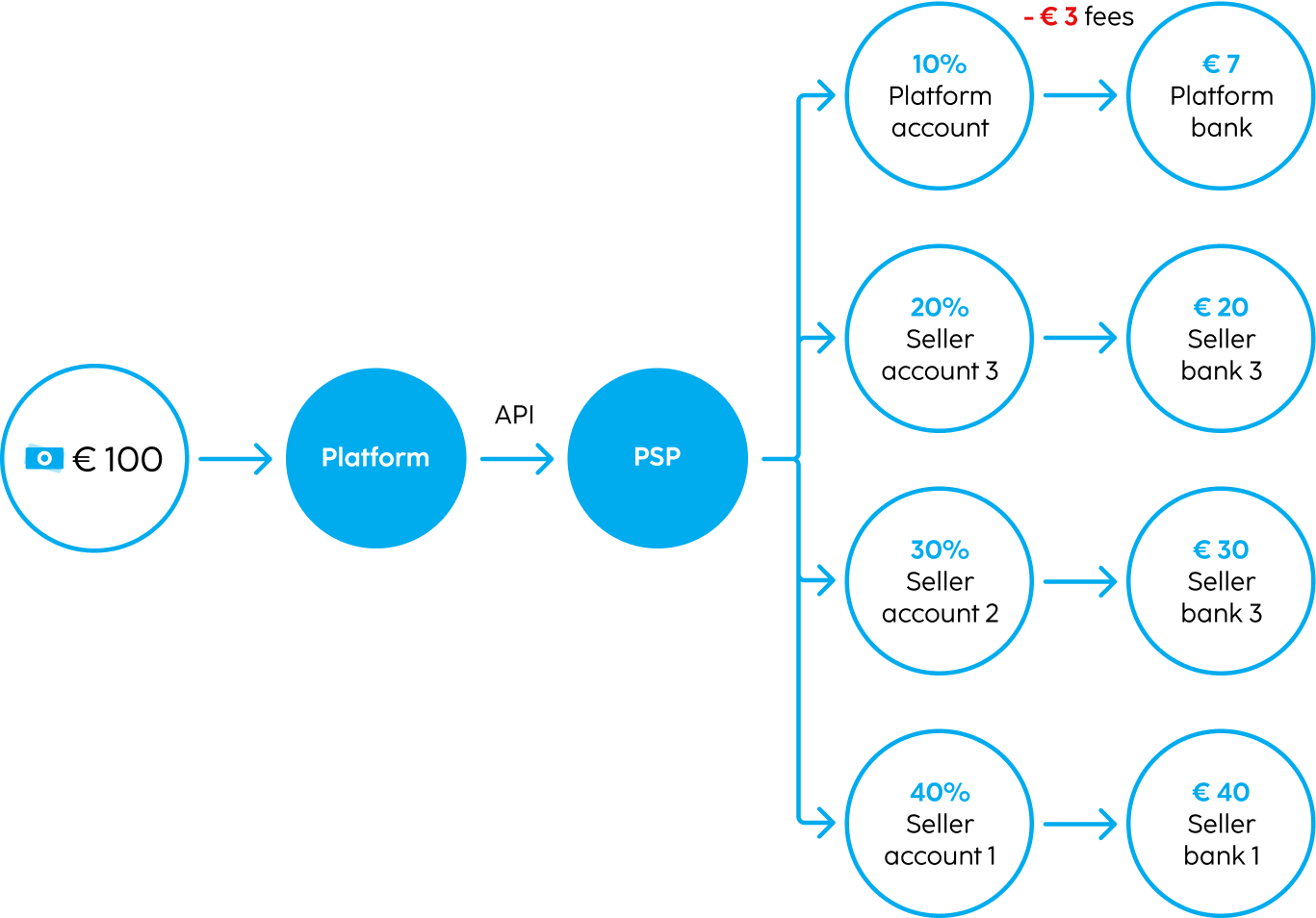

Split balance: This monetization model is most suitable when more than two accounts are associated with a single transaction, as in marketplaces, where different affiliates sell various products.

Here, the fee division cannot be done at the moment of the transaction. Even though the platform may take its percentage, how is this fee distributed among the different affiliates involved in the sale? In this case, it's necessary to access the balance where the transaction amount was received and transfer funds to each seller's account, according to their corresponding share.

All this works through the API, and while the platform needs to indicate to the PSP the parameters it wants for the different splits, the PSP must have the resources and tools to develop a fully customized system to ensure the process works effectively.

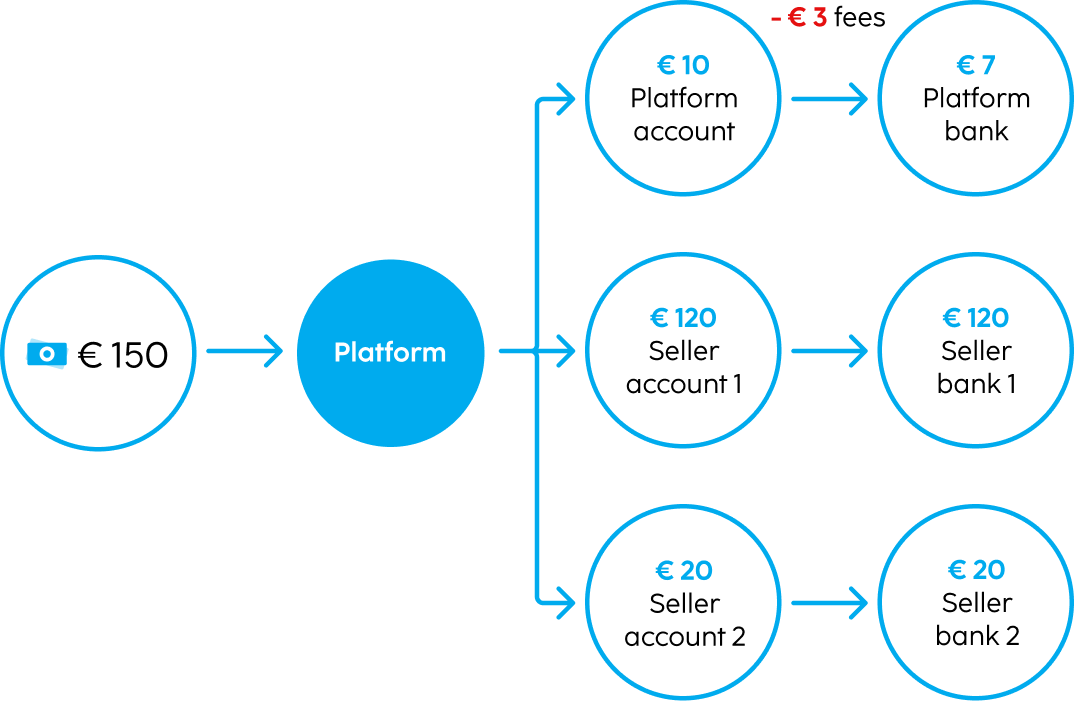

Buy & Sell: At MultiSafepay, we also offer this additional monetization model for platforms in a single line, that is, when the business itself charges the end user, as is the case with QR payments in restaurants, for example.

If the platform doesn't want to perform splits, we work with a wholesale price, and MultiSafepay transfers the funds to the forum.

The advantage of the Buy & Sell model is the operation's simplicity when monetizing a platform, as the transactions between the affiliate and the final user are carried out end-to-end without any splits on the platform's part.

However, each platform has specific needs, so it should be studied regarding monetization. Choosing the most suitable monetization method for your platform type is crucial to increase your revenue and ensure your business's sustainability.

Sitedish: Platform solution success by MultiSafepay

Sitedish is a platform that offers a complete package for delivery and takeaway restaurants. They have a website, a checkout system, and their own app.

Due to its meteoric success, Sitedish faced a management and affiliate incorporation problem, as demand from restaurants was increasing, which entailed a higher number of transactions.

When contacting MultiSafepay, Sitedish had scalability issues and faced a severe vulnerability problem related to compliance with PSD2 and KYC compliance.

As you can see, these are 2 critical points for managing any platform, and for Sitedish, it was a turning point.

To solve these challenges, MultiSafepay provided Sitedish with a customized solution that consisted of creating a primary account and associating their affiliate accounts to it, thus operating from a single control panel.

Besides, we set up the automated onboarding of each affiliate through our API with a personalized link, which allowed Sitedish to resolve PSD2 and KYC compliance issues in one go.

As a result of implementing these two tools, Sitedish solved its scalability and onboarding problems, managing affiliates and transactions effectively and complying with the necessary regulations.

Accelerate your platform with MultiSafepay and boost your scalability

At MultiSafepay, as experts in payment solutions, we pay attention to the needs of each business model to design solutions that truly help our partners to develop and scale their businesses successfully.

All our solutions aim to improve internal platform processes so that you save time and resources and can continue to develop your business sustainably. In addition, we also have over 40 local and global payment methods, more than 35 in-house developed integrations, and a range of state-of-the-art Android POS terminals to take physical payments.

Ready to discover the right strategy for your platform? Contact us if you need help optimizing your platform.