Payment orchestration: What is it and how does it benefit your checkout?

What is payment orchestration?

As the name suggests, payment orchestration is the process of controlling and distributing the end-to-end payment flow. The orchestration includes many operations, such as authorizing and routing payments, but also settlements and payouts. Essentially, payment orchestration can help businesses improve their payment infrastructure. Payment orchestration can be interpreted in various ways, but we'll focus on two of the most common interpretations in this piece. These are the following:

One is the process of using multiple payment service providers (PSP) at the same time (either directly or through a platform), which can be of great value when processing transactions on different continents, or as a fallback in the case of outages (just to name a few examples). It can also allow the merchant to test multiple PSPs against each other to see who's performing the best.

The other type of orchestration is single PSP payment orchestration. Here, your dedicated PSP uses a myriad of solutions and settings to get the most out of your payment traffic. This process is especially potent when using an acquiring PSP, as they have significantly more control over the end-to-end payment flow.

Main benefits of payment orchestration for your business

Let's look at the benefits of these optimalizations for your payment traffic. Essentially, both types of payment orchestration mentioned above can deliver similar benefits, only the single-PSP orchestration will work within the PSPs own ecosystem, whereas the multi-PSP orchestration will work with the infrastructure of multiple providers.

Smart routing

Routing transactions to various payment gateways and methods based on various factors greatly increases the chance of success.

A few examples of these factors:

- Order amount

- Payment method

- Currency

- Geolocation of merchant or customer

- Risk profile

Smart routing takes the above factors (and more) into account to automatically optimize the end-to-end performance of your payment infrastructure.

It all starts when the consumer enters the checkout. Through our ‘get payment-methods’ function (which is supported in all major integrations and our API), the best possible mix of payment methods is retrieved for the end-user. Taking various parameters, such as language settings, min/max order value, and the locale of the customer into consideration.

Once the customer proceeds with a payment method, the routing of said payment is orchestrated to the best performing path. For example, for a card payment the MultiSafepay fraud engine weighs whether the transaction is deemed safe, and if true the transaction will be routed through the path of least resistance, whether that be a frictionless 3DS or 3DS exemption flow.

Initiating a payment is just one part of the puzzle; the scheme, the issuer and the customer all have their role to play and by processing and analyzing millions of transactions, and using this data to create best practices (all steps a consumer or merchant will never see), MultiSafepay balances the risk-reward equation to drive conversion to its absolute max. That's why the leading brands offload this knowledge to an acquiring PSP – knowing they have the knowledge and capabilities to do what's best.

Smart retry

The online, end-to-end payment flow involves many potential points of failure. Think of customers failing their credit card authentication or a PSP trying to process through an SCA exemption, but the issuer rejecting said attempt. This can lead to a so-called ‘soft decline’. Payment orchestration also considers this and can automatically retry a failed transaction like the one mentioned above with a different PSP or a different authentication method, depending on the type of payment orchestration. As you can imagine, if you're processing through a PSP that can't handle soft declines, adding a second PSP that can handle them can turn many failed transactions into successful ones.

Scalability

Payment orchestration benefits scalability in many ways. You can think of core business operations, such as accounting, refunding, and payouts, but also the matter of entering new markets successfully. Payment orchestration can help you streamline all these operations and run them through the right channels – greatly improving your everyday business. Also, when operating on a large scale, enduring an outage can be disastrous. Having multiple options, or a payment provider that uses multiple data centers and backups, alongside a myriad of payment methods, can be key to success. Especially if the PSP has the infrastructure in place to automatically route your traffic.

Putting it all together

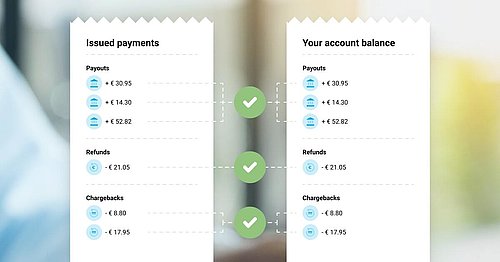

When taking the above benefits of payment orchestration and putting them together, it boils down to using a provider that has the infrastructure in place to help you achieve more while minimizing the input from your end. Streamlining your integration, reconciliation, and reporting operations allows you to maximize your potential revenue, while being protected from outages and disruptions.

By choosing MultiSafepay, you'll gain access to a single integration for both online and point-of-sale payments, which is constantly evolving and innovating to optimize your revenue.

Our opinion: a competitive landscape is a healthy one

We believe the rising popularity of payment orchestration is a good thing for the market. After all, claims are one thing, proving those claims is another.

Payment orchestration makes this a very accessible option. As such, we're not scared to test our mettle against other payment providers.

The past years, we've won over some of our clients through this process. The best way to learn who performs the best is to test it. Say you're a merchant and you're not sure which payment provider you'd like to use. Work with two and split your payment traffic. Give it a month or two and see the results. It's one of the best ways to discover who has the best uptime and conversion rates.

So, can payment orchestration be interesting for you?

Let's have a look at some of the aspects that can make payment orchestration interesting for your business.

If you:

- are unsure whether your checkout is fully tuned to your (international) target audience,

- would like to create a better, more scalable payment infrastructure,

- are looking to reduce costs per transaction, while increasing efficiency.

Then payment orchestration might be just the thing for you.

Ready to get more out of your existing payment traffic?

Don't hesitate to reach out to our experts, we'll gladly help you out.